Life insurance coverages information

Home » » Life insurance coverages informationYour Life insurance coverages images are available in this site. Life insurance coverages are a topic that is being searched for and liked by netizens today. You can Find and Download the Life insurance coverages files here. Get all free images.

If you’re searching for life insurance coverages pictures information linked to the life insurance coverages keyword, you have visit the right site. Our website frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Life Insurance Coverages. Life insurance carries a mandatory coverage in hiring, it is death coverage. Bestow is backed by north american company for life and health insurance. Commercial insurance refers to a policy that is meant to protect a business from future risks. Some examples of common life insurance riders include:

State Farm Insurance Joins Other Corporations Supporting From prweb.com

State Farm Insurance Joins Other Corporations Supporting From prweb.com

The ideal life insurance coverages for everyone. But there are different options that can be added: Learn more about life insurance coverages and what the best options are for you. So no choice is bad. A life insurance rider is a supplemental policy that provides additional coverage for certain situations or events. The ability to balance cash value growth with your preferred risk tolerance;

Without it, you could burden those left behind with overwhelming expenses.

It is essential that you fully understand the basics of life insurance coverage. Insurance coverage protection is the quantity of threat or legal responsibility that’s lined for a person or entity by means of insurance coverage providers. But there are different options that can be added: Term life insurance can be an affordable way to help support financial obligations that have an expiration date — like mortgages and college costs. The simplest type of permanent life insurance coverage is whole life. What’s covered by life insurance falls into two categories:

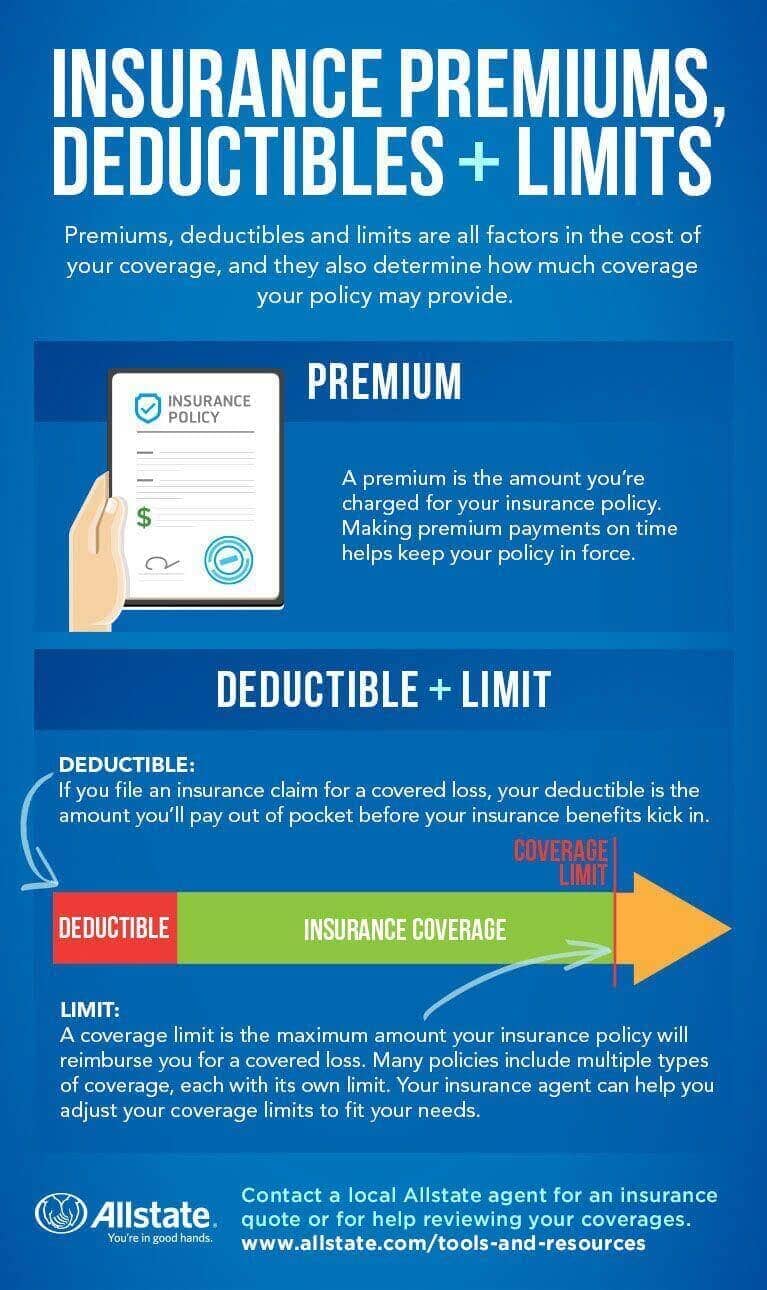

Source: allstate.com

Source: allstate.com

Life insurance already covers death by accident. But there are different options that can be added: Bestow believes that great life insurance should be affordable, convenient, and smart. The advantages and disadvantages of buying a life insurance policy for your kids here are the different types of life insurance policies: Commercial insurance refers to a policy that is meant to protect a business from future risks.

Source: allstate.com

Source: allstate.com

Flexibility to adjust your plan over time 4; Let our representatives find you the best coverages suited for your business. Whole life insurance (permanent) as a type of permanent life insurance, whole life insurance provides coverage for your entire lifetime, paying your benefit no matter when you pass away — as long as you keep paying your bill. Cash value that builds with the security of downside protection ; Life insurance carries a mandatory coverage in hiring, it is death coverage.

Source: prweb.com

Source: prweb.com

Bestow is backed by north american company for life and health insurance. Life insurance coverages can be confusing. Whole life insurance (permanent) as a type of permanent life insurance, whole life insurance provides coverage for your entire lifetime, paying your benefit no matter when you pass away — as long as you keep paying your bill. What’s covered by life insurance falls into two categories: Depending on the contract, other events such as terminal illness or critical illness can.

Source: prweb.com

Source: prweb.com

Variable universal life insurance offers: Term life insurance (the most popular type of life insurance) lasts for a specific amount of time, while whole life insurance (the most popular type of permanent coverage) lasts your entire life. For living expenses and to pay off debts. Life insurance aims to provide monetary relief to the nominee owing to the premature death of an individual. The simplest type of permanent life insurance coverage is whole life.

![Allstate Home Insurance [Updated 2020] Discounts and Allstate Home Insurance [Updated 2020] Discounts and](http://blog.insurify.com/wp-content/uploads/2020/02/allstatehomeinsurance.jpg) Source: insurify.com

Source: insurify.com

Life insurance aims to provide monetary relief to the nominee owing to the premature death of an individual. Mortgage or rent payments, child care, outstanding credit card or loan debt, maintaining a current lifestyle, or. Life insurance carries a mandatory coverage in hiring, it is death coverage. This can be helpful for those who need to stick to a budget. For living expenses and to pay off debts.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance coverages by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Learn spanish game information

- Melbourne house sitting information

- Learn french online for kids information

- Marty mcfly hoverboard information

- Learn fluent spanish information

- How to write a story plot information

- Information on insomnia information

- Medical tourism sites information

- Mayflower model ship information

- House sitter london information